Clear, buyer-first advice for anyone considering a static caravan holiday home in Shropshire.

You’ve found the perfect spot by the river.

You can already see yourself sitting on the decking, watching the water drift by, a fishing rod in hand or a glass of wine on the table.

Then someone mentions insurance.

It’s the boring part of the dream. But getting the right static caravan insurance means you can relax when the winter weather rolls in, knowing your investment is safe.

Key Facts: Static Caravan & Lodge Insurance at a Glance

| Question |

Short Answer |

| Is it legally required? |

No law requires it, but park licences usually do. |

| Does it cover floods? |

Yes. Standard policies cover storm and flood. |

| Are contents insured? |

Usually optional. Check your specific policy. |

| Is liability included? |

Yes. Most parks require £2m–£5m liability cover. |

| Can I insure older units? |

Yes. But "New for Old" cover may not be available. |

| What if I let it out? |

You need specific cover. (Note: Seven Oaks is owners-only). |

| Can I use any insurer? |

Generally yes, as long as cover meets park rules. |

What This Guide Covers

- Cover: What is actually protected.

- Values: Static caravans vs lodges.

- Costs: What drives the price up.

- Claims: The drain-down trap.

- Providers: Who to call for a quote.

- Checklist: Questions to ask before buying.

1. Your Static Caravan & Lodge Insurance Safety Net

You don't buy a holiday home to worry about paperwork.

You buy it to escape.

But the reality is, nature happens. Storms roll in over the Welsh hills. Rivers rise. Pipes freeze in January.

This guide cuts through the jargon to tell you exactly what you need to look for in a policy if you are buying in Shropshire or Powys.

When the unexpected happens, you want one thing: a simple phone call that sorts it out.

2. Understanding Static Caravan & Lodge Insurance

How this type of insurance works

Static caravan insurance is a specialist product.

Unlike car insurance, it isn't mandated by UK law. However, almost every holiday park pitch licence requires it.

There are two main ways your holiday home can be covered:

New for Old: If your caravan is destroyed (e.g., by fire or flood), the insurer replaces it with a brand new equivalent model. This is the gold standard but costs more.

Market Value: The insurer pays what your caravan was worth the day before the accident. This is cheaper, but if you have an older van, the payout might not be enough to buy a replacement.

How it differs from home insurance

Home insurance is for bricks and mortar. It won't cover a structure made of timber and aluminium.

Touring insurance is for caravans that move on the road. It won't cover a static unit that sits on a pitch all year.

You must get specific "Static Caravan" or "Holiday Lodge" insurance.

3. Static Caravan vs Holiday Lodge Insurance

While they serve the same purpose, insuring a lodge is slightly different from insuring a caravan.

Higher values for lodges

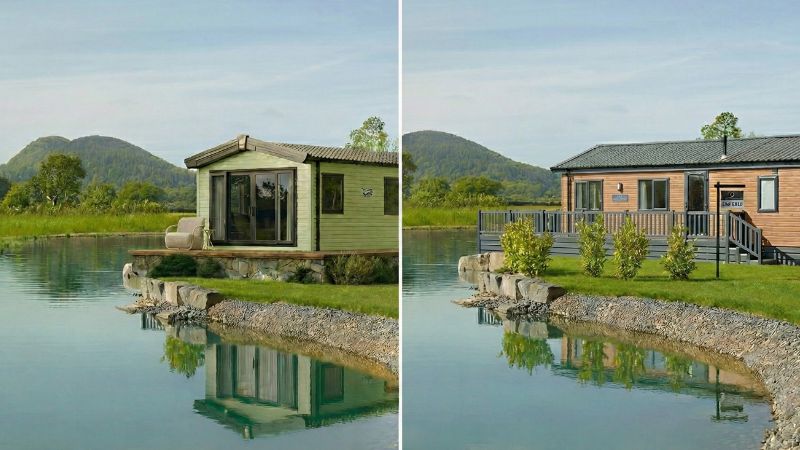

Lodges are built to residential standards (BS3632). They are larger, better insulated, and often sit on substantial decking.

This means the "Sum Insured" will be much higher. If you have a luxury lodge at Seven Oaks, ensure your policy covers the full replacement cost, including the decking and skirting.

New for Old limits

Because lodges last longer, insurers often offer "New for Old" cover on them for up to 20 or 25 years.

Standard static caravans might only get this cover for 10 or 15 years before dropping to "Market Value."

4. What Static Caravan & Lodge Insurance Typically Covers

Weather damage

Shropshire is beautiful, but the weather can be wild.

Most comprehensive policies cover:

- Storm damage to roofs and skylights.

- Flooding (essential for any riverside location).

- Falling trees or branches.

Theft and vandalism

This covers break-ins and malicious damage.

Insurers love parks like Seven Oaks because we are secure and owners-only. Be sure to mention the park's security measures (barriers, CCTV, resident staff) to potentially lower your premium.

Public liability

If a visitor trips on your decking step, you could be liable.

Most parks require you to have at least £2 million in Public Liability cover. This protects you against legal claims from third parties.

5. What Affects the Cost in 2026?

Location and flood risk

Insurers rate every park based on its postcode.

- Coastal: High wind risk.

- Riverside: Flood risk.

- Inland Countryside: Generally lower risk, but frost is a factor.

Seven Oaks is located on the banks of the River Severn. While our pitches are elevated and well-maintained, insurers will factor the river into their quote.

Age and condition

Older units cost more to insure because parts are harder to find, and they are more susceptible to weather damage.

Usage: The "Owners-Only" Bonus

This is where Seven Oaks owners win.

Insurers charge extra for parks that allow commercial subletting (holiday rentals) because guests are riskier than owners.

Because Seven Oaks does not allow subletting, your premium should be lower than on a commercial park. Make sure your insurer knows this.

6. How the Claims Process Works

The "Drain Down" Trap

This is the single biggest cause of rejected claims in the UK.

Shropshire winters can get cold. If water is left in your pipes when the park is closed (or when you aren't there in winter), it can freeze and burst the pipes.

Crucial: Most policies state you must "drain down" the water system between November and March if the unit is unoccupied. If you don't, and a pipe bursts, they won't pay.

At Seven Oaks, we offer a drain-down service to help you comply with this.

What to do when something happens

- Stay safe: Do not enter if there is structural or electrical damage.

- Mitigate: Turn off the gas and water if it is safe to do so.

- Document: Take photos before you clean anything up.

- Notify: Tell the park team immediately so we can help secure the unit.

7. Choosing Providers and Policies

Types of provider

Specialist Brokers: Companies like Leisuredays, Caravan Guard, or Towergate specialise in this market. They understand park rules and drain-down clauses.

General Insurers: High street banks often offer "holiday home" insurance, but check the small print carefully. They might not cover park-specific risks like decking or skirting.

Park rules

At Salop Caravan Sites, we don't force you to use a specific insurer. You are free to shop around.

We just ask to see a copy of your certificate to ensure the Public Liability cover meets our park standards.

8. 2026 Trends in Insurance

Climate impact

Insurers are paying out more for weather events. Expect premiums to rise slightly across the industry, especially for riverside locations.

Modular cover

Policies are becoming more flexible. You can often choose to insure just the structure, or add contents, gadgets, and sports equipment (useful for fishing gear or golf clubs) as extras.

9. Final Checklist Before You Buy

Use this checklist before you commit to a policy:

☐

Values: Does the sum insured cover the cost of a brand new replacement + decking?

☐

Liability: Does it meet the park's £2m–£5m requirement?

☐

Winter: Do you understand the drain-down rules?

☐

Usage: Does the insurer know this is an owners-only (no subletting) park?

☐

Flood: Is flood cover definitely included? (Critical for riverside locations).

10. FAQs: Static Caravan & Lodge Insurance

How much does static caravan insurance cost?

It varies, but for a standard unit in a riverside location, expect to pay between £150 and £350 per year. Lodges will cost more due to the higher rebuild value.

Is static caravan insurance a legal requirement?

No, but it is a requirement of the Seven Oaks licence agreement. You must have it to keep your caravan on the park.

Do I need different cover if I let my caravan out?

This doesn't apply at Seven Oaks. We are an owners-only park, so you do not need commercial hire-and-reward insurance. This often keeps your premium lower.

What happens if I don't drain down in winter?

If your policy requires it and you don't do it, any damage caused by frozen pipes will not be covered. It is the most common reason for claim rejection.

Does insurance cover my fishing gear?

Standard contents cover might have a limit per item (e.g., £250). If you have expensive rods or tackle, check the policy limits or add them as specified items.

Can I choose my own insurer?

Yes. Seven Oaks allows you to choose your own provider, provided they meet our minimum liability standards.

11. Conclusion: Confident, Protected Ownership

Insurance isn't the exciting part of buying a holiday home. But it is what lets you enjoy the exciting parts without worry.

When the river rises or the frost bites, you want to know you are covered.

Get it sorted once, check the drain-down clause, and then forget about it. That's the goal.

The fishing, the peace, the escape—that's what you're here for.

Why Choose Seven Oaks?

Located on the banks of the River Severn, Seven Oaks offers a rare mix of 5-star luxury and countryside tranquillity.

- River & Lakes: Half a mile of River Severn fishing plus two private lakes.

- Owners Only: A true community feel with no subletting.

- Long Season: Enjoy your holiday home from 1st March to 2nd January.

- Facilities: Fitness suite, bowling green, pitch & putt, and laundry.

- Peace of Mind: Our pitch fees are transparent and our licence terms are clear.

Request your free brochure today to see our latest plots.

Seven Oaks at a Glance

| Feature |

Details |

| Location |

Crew Green, Shropshire/Powys Border (SY5 9BU) |

| Season |

1st March – 2nd January (10 months) |

| Site Fees (Annual) |

From £3,838.66 (Single) to £5,094.88 (Double) |

| Subletting |

No (Owners, Family & Friends only) |

| Facilities |

Fishing (River & Lakes), Gym, Bowling, Golf |

| Distance |

~50 mins from Wolverhampton, ~1hr 15 from Birmingham |